How much HOME can you afford?

Before you start shopping for a home, you need to know what kind of home to shop for. To determine that , of course, you've got to figure out how much you can afford to pay each month.

Fortunately, there's a pretty simple formula for coming up with this number. It's the Federal Housing Administration (FHA) formula that many mortgage lenders use. The FHA has found that most people can afford to budget 31% of their gross monthly income to housing expenses, depending on total debt. Buyers with no debt can budget as much as 43% of monthly income to housing.

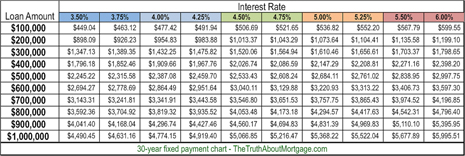

The chart tells you how much your monthly mortgage might be based on a home's selling price. Remember to keep in mind that the monthly figure from this chart is based on a 30-year fixed mortgage and includes monthly principal and interest payments only. Taxes and insurance - which vary from community to community - are not included.

So if 31% of your gross income is, say, $604, that doesn't mean you can pay a $604-per-month mortgage. You need to look at a mortgage somewhat below that, to leave room for taxes and insurance. HUD Home Network helps you estimate how much your total costs will be.

Mortgage payment calculator.

Monthly principal, interest payments for 30-year, fixed rate mortgage. Monthly taxes, insurance not included.

Find out how much you can afford by clicking here.